When it comes to financial services, there are many different sectors. Each one plays a unique role in the economy. Pocketbook Agency provides an overview of each one to help you determine which career path is right for you.

Banking focuses on direct savings and lending, while insurance companies offer coverage against risk. Regulatory bodies ensure transparency and uphold consumer protection.

Definition

When deciding on a career path, understanding the basics of the economy is vital. The economy is broken up into segments called sectors, each containing businesses that offer similar goods or services to consumers. Financial services are one of the largest sectors in the world, accounting for the biggest share of the market in terms of earnings and equity.

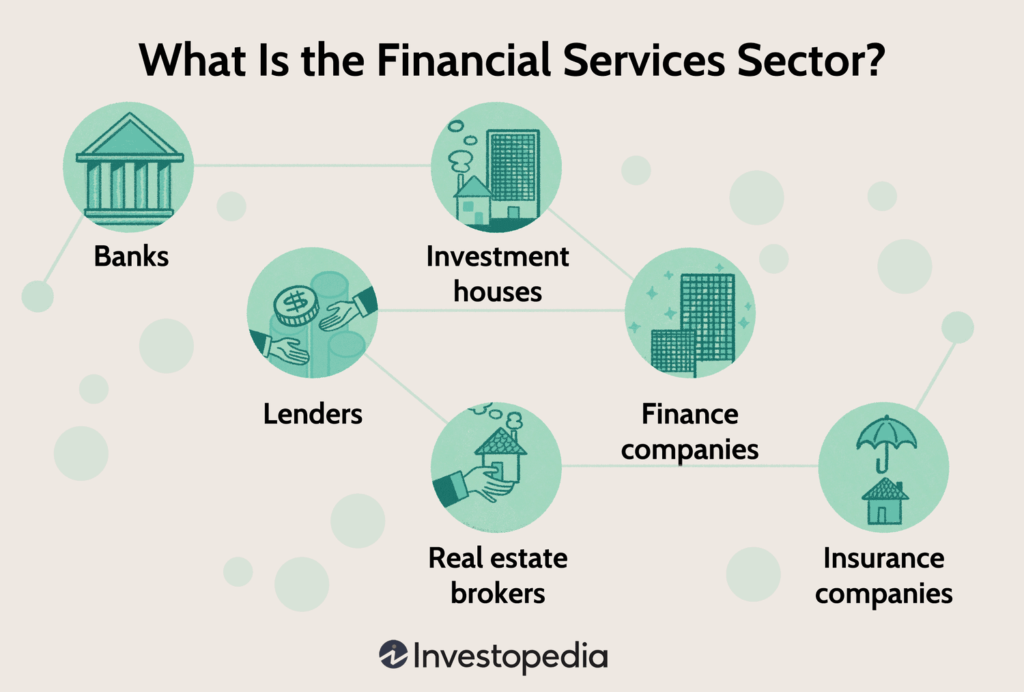

Financial services are the processes that help people and businesses obtain economic goods, such as loans, credit cards, mortgages, payment services, real estate, and taxes and accounting. These are offered by a wide range of businesses, including banks, investment firms, and credit card companies. Financial services also include companies that manage assets and provide insurance.

A good way to think about financial services is “everything that touches money.” This includes depositing a check at a bank, obtaining a loan or a mortgage, investing in stocks or mutual funds, and even paying your bills through a service provider. However, it is important to note that financial services and financial goods are not the same thing. A financial good is something tangible, such as a house or an automobile, while a service is a temporary task.

Functions

The financial services industry provides a wide range of functions. These include deposit-taking, lending of all types, credit rating and assessment, financial leasing, payment systems and telecommunications; and advisory, intermediation, and auxiliary services (such as issuance management, registrar of issue, merchant banking, pricing of securities, etc).

These companies help individuals and institutions invest their savings in profitable businesses and projects. They also assist them with acquiring necessary infrastructure and machinery. This helps increase productivity and creates more job opportunities. Moreover, they provide a platform for the investors to diversify their portfolios and reduce risks.

It is important for the firms to understand their clients’ needs and provide them with a wide range of products and services. This will enable them to maintain their business by satiating the customers’ demands. Financial institutions also encourage their employees to pursue further education and training. This will help them to keep up with the changing trends and new tools. It will also allow them to improve their customer service. Besides, it is essential to have a strong brand image and good reputation in the market.

Subsectors

There are many different subsectors in the financial services industry. Some of them include credit card services, mortgage lenders, investment banks, and insurance companies. Some of them also provide services such as cash management and notary services. Other financial services include prepaid cards, credit rating agencies, and angel investors, who provide financing to small businesses and startups in exchange for a stake in the company.

A healthy financial sector is a critical part of a country’s economy. It advances loans for businesses to expand, grants mortgages to homeowners, and issues insurance policies that protect consumers and their assets. It also helps people build savings and retirement funds. Financial services thrive in an environment where interest rates increase moderately rather than quickly, and where there is a good balance between regulation and the ability of financial services firms to innovate.

In addition to traditional banks, the financial services sector includes large hedge funds and mutual funds. These organizations need custody and back-office services for their investments. Regulatory bodies, such as the Financial Industry Regulatory Authority and the Office of the Comptroller of the Currency, oversee these institutions and ensure that they are operating fairly and honestly.

Regulatory bodies

Regulatory bodies oversee different sectors of financial services to ensure their operations are transparent and that clients are treated fairly. They also enforce laws and regulations to protect consumers. In addition, they help maintain financial stability and promote innovation and fair competition in the industry.

Financial regulation is a complex field that encompasses many different activities. It is essential to keep up with the latest developments in this area. For example, regulators must determine how much capital financial institutions should have to avoid a financial crisis. They must also establish guidelines and standards for risk management practices. They must also ensure that financial institutions are able to absorb losses, while protecting their investors.

A career in financial services requires a strong educational background and professional experience. Those who want to become financial regulators should have degrees in finance, economics, or law. Regulatory agencies should be independent of political influence, and their officials should have security of tenure and accountability. They should also be able to demonstrate that they manage their budget effectively. This will help them carry out their mission more efficiently.

Careers

When it comes to careers in financial services, there are plenty of options. You can find work in investment banking, credit card processing, real estate, or insurance. There are also online programs that can help you build your skills in these areas. These courses can be more flexible and affordable than traditional undergraduate or graduate degrees, and they often offer instruction from world-class faculty.

Despite the wide range of careers in financial services, it can be hard to determine what area is right for you. The best way to break into the industry is to start with an entry-level position and work your way up. This will give you the experience and training you need to advance in your career.

Some jobs in the financial services sector require specialized knowledge and training, while others only need a bachelor’s degree or equivalent experience. These jobs include insurance brokerage, accounting, actuarial science, investment advice and management, and stock trading. Regardless of the job, it is important to have a solid understanding of the industry and markets.